If you’ve tested the costs out-of RVs not too long ago, it’s no surprise of several rely on Camper capital. Getting full-timers, high pricing commonly suggest replacement their homeloan payment with a keen Camper payment. Now we will give you the basics of Rv financial support having complete-timers to help make your next Rv get quite simple.

Why is it Difficult to get Funded just like the the full-Go out RVer?

Whenever finance companies loan large volumes of money, they truly are getting an enormous risk. They truly are in search of balance and you will texture to make certain you could shell out right back the mortgage completely. These types of same financial institutions also want a warranty that when borrowers end and make money, they may be able repossess the Rv.

A complete-day RVer can take its Camper anywhere in the world, therefore it is difficult, maybe even hopeless, towards the bank to track her or him down. Of many full-timers sell their houses in advance of showing up in street, which are a major red flag to possess a money agencies.

RVs rating categorized as the deluxe issues. Whenever you are trucks and you may residential property is actually necessities, RVs are not. Therefore, banks will often have a whole lot more stringent standards in terms of approving resource to have RVs. not, some prominent banks have a tendency to loans complete-go out RVers.

Whom Profit Full-Time RVers?

Many RVers expose matchmaking which have local credit unions in expectation out of supposed complete-time. Credit unions normally accept you for a keen Camper financing at the a great rate of interest. When you have a reliable reference to a neighbor hood borrowing from the bank partnership, it would be far better check with them first.

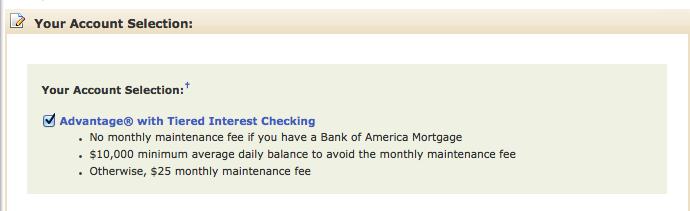

Highest financial institutions such as You Lender, Bank out of America, and you can 5th 3rd Lender are common popular investment choices. This type of higher businesses have a great deal more hoops on the best way to jump courtesy, however, they have been great alternatives for Rv resource getting complete-timers. A number of the huge finance companies are more unwilling to agree your, but they’re going to commonly supply the lower rates of interest.

Precisely what do You ought to get financing?

In advance traveling Rv dealerships, there can be a handful of activities to do to boost their acceptance chances. Let us hunt!

Good credit Rating

Since the RVs is actually deluxe activities, a low credit history will likely end up in a denial. For this reason, if you are searching to obtain an Camper financing soon, it is preferable never to get every other investment prior to the purchase of Rv.

When you yourself have a low credit score, initiate clearing up your credit before you apply for a loan. Financing assertion normally damage your odds of approval whilst will require numerous tough borrowing checksing towards resource processes that have good credit history renders to possess an easier financial support techniques.

List of To your-Date Payments

Monitoring of on-time money is important having securing Rv financing to own full-timers. You do not want missed otherwise late costs in your credit score. Banks would be hesitant to financing currency when they see a beneficial history of inability and come up with towards-day payments.

While you are there are numerous strategies to boost your credit score rapidly, there’s absolutely no magic pill getting track of later payments. A later part of the otherwise missed commission takes doing 7 ages to fall out of your credit score.

Proof of Earnings

Finance companies would like to know that you are not overextending yourself by purchasing an Rv. Make sure to also have evidence of money. Of several finance companies requires a position getting a year or more, depending on the sorts of condition. Eg, earnings regarding independent contractors will cannot matter given that income if this pertains to financing approvals. Hence, you will need an extended work background to exhibit stable proof earnings.

A down payment

Among the best a means to raise your odds of taking recognition to have an Rv loan is through putting off an enormous deposit. Banking institutions like down payday loans Flagler repayments, since they have been a sign of monetary balances and you may obligation.

When you’re incapable of get approval, getting down a big advance payment can also be considerably enhance your chances. Off costs are also good for this new customer whilst helps remove bad collateral as the RVs depreciate rapidly. Regrettably, it’s easy to are obligated to pay more a keen Rv is worth once the original 12 months, especially if there is little deposit.

Exactly what Credit rating Should you have to locate Camper Resource?

As the banking companies evaluate RVs just like the deluxe products, it could be harder discover an enthusiastic Camper financing. Investopedia suggests aiming for a rating off 700 or even more just before applying for a keen Camper loan. If the credit rating isnt over 700, there are numerous steps you can take now to aid quickly improve rating.

Don’t sign up for whatever requires a credit check about not too distant future. Numerous borrowing checks on your own credit history try a warning sign to loan providers. It is going to lower your score, and you want all point you can purchase with regards to to help you Rv funding.

An excellent way to replace your credit history should be to pay of personal debt. Huge amounts of personal debt you certainly will rule to banking institutions which you can have difficulty and also make costs.

It may take months to truly get your credit rating so you’re able to an enthusiastic acceptable get having lenders, however it is really worth the effort. A far greater credit history function lower interest levels, and this saves your money in the long run. If for example the credit history is actually large, financial institutions will likely approve you but just with a top-interest rate otherwise big deposit.

In the event that you Money Your Rv once the an entire-Timekeeper?

Of numerous complete-timers envision you will want to enter the full-big date lifestyle having only a small amount loans that you can. Although not, anyone else state getting in control when financial support produces the approach to life it is possible to for almost all more individuals.

Since of several complete-timers promote their houses before showing up in path, they often times use the equity to repay the Camper mortgage. It means fewer and lower payments while they are RVing.

Navigating the industry of Rv money will be a trip from inside the itself, nevertheless need not be. If you think of showing up in road complete-amount of time in an enthusiastic Camper, start getting ready now let’s talk about the credit process. Doing the hard work today makes the process much easier whenever it comes for you personally to financing your perfect Camper. Just what info are you experiencing to have other RVers with regards to so you’re able to Camper capital to own full-timers?