Due to home prices skyrocketing over the past long time, forty-eight.1% of attributes having a mortgage or any other mortgage brokers cover about half their really worth, considering 2nd one-fourth data off ATTOM, a genuine property study corporation.

Once 124 straight weeks out-of family rates expands, it’s no wonder that the portion of collateral-steeped land ‘s the large we have actually viewed, and therefore the fresh new percentage of seriously under water money ‘s the low, Rick Sharga, https://availableloan.net/loans/parent-loans/ exec vice-president out of industry intelligence getting ATTOM told you on the report.

The ability to borrow on this guarantee is easily open to many, and lots of individuals are provided playing with next mortgages, family equity loan, otherwise HELOC to invest in household home improvements, buy good child’s degree, or consolidate debt. Of the knowing the subtleties out of property guarantee mortgage otherwise HELOCs, and exactly what it ways to enjoys a second financial, you may make an educated borrowing decision.

What is the next Home loan?

Another financial is actually an excellent lien on your property which is secure behind an initial home loan, explained Tabitha Mazzara, movie director from operations towards Mortgage Lender out of Ca.

Next mortgage loans don’t alter your present mortgage; they truly are an extra mortgage you are taking aside and you can pay-off separately regarding the mortgage you always get your home, plus family serves as security on the the fresh financing.

The expression next financial describes the fund is actually treated from inside the cases of foreclosure. For folks who fall behind on your own money therefore the home is foreclosed, your property will be offered to pay off the debt. In the proceeds of the income, very first or first mortgage – one you used to buy your household – is actually found basic. If there is any cash remaining, it is used on the second mortgage.

If i don’t have sufficient security to settle one another funds, the lender of 2nd home loan ount due. From the chance of not getting completely paid back, loan providers normally fees highest rates for the 2nd mortgages than to your primary mortgage brokers.

What exactly is a property Guarantee Mortgage?

In our current climate, they [taking right out a property guarantee loan] is advantageous if someone enjoys a price on their first financial as they can have fun with a moment mortgage to get away cash to cover renovations or pay-off existing debt, said Mazzara. The following mortgage is an excellent alternative once they don’t wanted the loan so you’re able to interfere with the original.

Predicated on Sarah Catherine Gutierrez, a certified monetary coordinator together with Chief executive officer of Aptus Financial, house equity financing have finest rates than many other different borrowing from the bank.

They generally features all the way down interest levels than just unsecured loans otherwise credit notes because your residence is the brand new collateral, she told you.

By , an average rate of interest getting property collateral financing try six.38% In comparison, an average annual percentage rate (APR) getting credit cards you to definitely evaluate appeal are %, together with mediocre Apr private fund is actually nine.41%.

Could there be a difference Anywhere between an additional Mortgage and you may a home Guarantee Mortgage?

The term next home loan relates to a variety of financing together with reputation they drops into the according to an important mortgage. A home collateral mortgage will likely be a type of a moment mortgage, you could together with incorporate a home collateral loan for people who no more have home financing and individual your home downright.

For individuals who very own property 100 % free and you can free from liens, the home equity financing otherwise credit line takes first updates, told you Mazzara.

Expert Suggestion

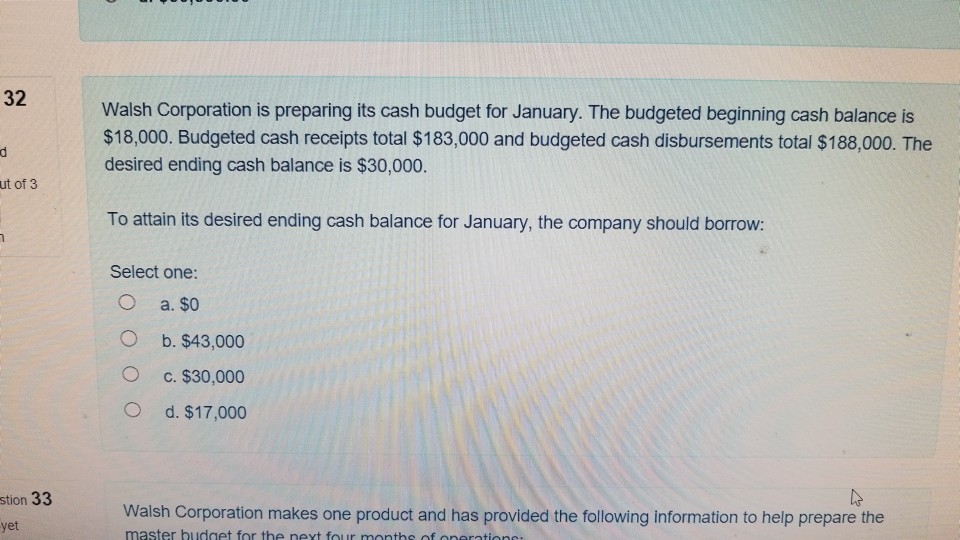

Whenever you are wanting an additional mortgage or house guarantee financing, consult quotes within this a limited time, eg a month, to reduce the fresh perception on the credit score.