If you have invested a lot of time considering an informed a way to trade a house at the same time, maybe you have seen individuals talk about things titled a link loan. Have a tendency to, real estate professionals and you will lenders often speak about link funds as the a solution to the issues you to deal with disperse-right up customers, because they connection the newest gap between your one or two qualities.

Bridge funds can, indeed, getting a great choice for flow-upwards buyers. For those who utilize them intelligently, you could get a lot of financial independency of your home lookup. Otherwise (otherwise can not) fool around with one novel money, you may need to narrow down brand new parameters when shopping for an alternate the place to find ban more vital attributes.

Like other areas of investing a house, the real well worth and you can usability out of a connection loan all depends in your personal state, requires, and you may means. So if you want to get an informed guidance you’ll be able to with the if or not a connection mortgage is actually for you, follow this link so you’re able to plan a period of time with the circulate-up to acquire masters of one’s Keri Shull Team to express their financing choice.

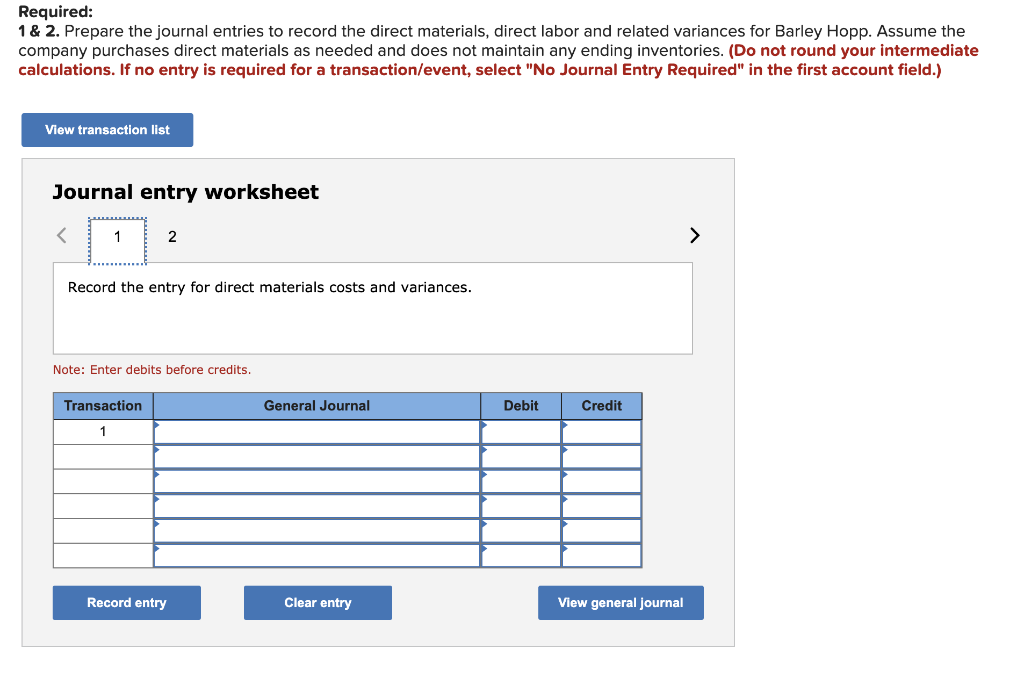

What exactly is a connection Financing?

Within the key, a connection loan is pretty simple. It is a money choice that allows one to use the collateral in your newest the place to find spend on the mortgage on the new home . Thus it’s not necessary to anticipate your current assets to market to liquidate its well worth.

It is important to observe that connection funds is temporary investment solutions. In the place of lengthened-name financing, they aren’t made to are present for many years (or years). The cash which you borrow inside a bridge financing is supposed to help you bridge new gap between the closings, so you’re able to with confidence make household.

Generally, link financing try equipment to deliver more control along side timeline in your home pick and you may profit. If you have the flexibility provided of the a connection loan, you can save money of your own precious time selecting your ideal home, rather than getting stuck so you’re able to a rigorous plan predicated on your own home revenue.

That being said, connection money commonly usually the best option getting a change-up customer, according to for each family members’ condition. Here are some of the most extremely prominent positives and negatives of bridge financing programs.

Advantages so you’re able to Link Money

The main benefit of delivering a connection financing are, as previously mentioned a lot more than, the latest economic freedom they may be able leave you. When you find yourself in a position to borrow secured on your current house’s equity, you usually have more options and you can liberty in your home search.

One other head pro regarding a bridge loan would be the fact a beneficial creative realtor may use them to make your home purchase bring way more persuasive. Because link money allow you to borrow secured on your existing security, you are able to treat certain contingencies on the provide and you may earn a house without getting the highest bidder. But not, this will be a choice that you should create with your actual home representative – since it depends on yours state and requires.

Cons in order to Link Fund

Connection funds are often more expensive than important home collateral finance. Centered https://cashadvancecompass.com/loans/1500-dollar-payday-loan/ on SoFi, the pace into a connection financing could be to 2% more than business pricing having 29-12 months fund – therefore bridge financing can prove high-risk if you aren’t in a position to help you easily outlay cash from which have a house revenue.

Some other scam regarding a connection loan, hence, is because they are only a good idea if you’re able to quickly promote your residence. If you don’t, the interest is balloon. If you’re not able to promote your first domestic for a very long time, pressure of obtaining your new house equity mortgage plus the link loan you may quickly grow.

The other well-known disadvantage of a bridge mortgage is you should be able to be eligible for one another homes at the exact same go out. While this is yes you’ll be able to, it means that bridge fund tend to be rarer than simply traditional mortgage items. Particularly in broadening places for example DC and you may Arlington Va, it could be difficult for most people to get qualified for each other money at the same time.

Try a bridge Financing Right for Me personally?

Sooner, it is hard to choose even when a link financing is actually a right selection for your unless of course we realize about your needs and you may means. That’s why we suggest that you get in touch with the Keri Shull Team today and you will schedule a time to meet with among the disperse-right up to invest in professionals. We’ll take you step-by-step through debt choice in addition to positives at the job around and set you in touch with mortgage lenders that offer link loans such as for instance our regional lover’s Very first Offers Home loan when planning on taking the following strategies.

You’ll find, however, of a lot innovative options that one may attempt financing the disperse-up to purchase state – we had want to talk to you so we can also be determine which is perfect for your!

Regardless of whether your home is inside Arlington Va, shopping for an alternate devote Washington DC , otherwise elsewhere in the DMV – the audience is right here to support you and let get you toward your ideal home!

Disclaimer: The above stuff is supposed to have training simply; it is not intended to be financial guidance. To have a personalized consultation of your financial choices, excite e mail us during the (703) 436-2191.